georgia property tax exemption codes

While the state sets a minimal property tax rate each county and municipality sets its own rate. Learn More at AARP.

Sales Taxes In The United States Wikipedia

Any Georgia resident can be granted a 2000 exemption from county and school taxes.

. You must meet the requirements of Georgia Law for exemption under code section 48-5-41. To obtain verification letters of disability compensation from the Department of Veterans. You may qualify for the S1 exemption.

Complete Edit or Print Tax Forms Instantly. Your cars must be registered in Newton County and you. Ad Our Property Tax Records Finder Locates Local Records Fast.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Property taxes are the cornerstone of local neighborhood budgets. Get In-Depth Georgia Property Tax Reports In Seconds.

2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION.

Georgia Code 48-5-41 provides an exemption from ad valorem. Hall County Board of Commissioners PO. To receive any Exemptions you must apply in person at the Tax Assessors Office located at.

Ad Access Tax Forms. Ad Access Tax Forms. Georgia Tax Center Help Individual Income Taxes Register New Business.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. If a person that owned a home with a fair market value of 100000 in an unincorporated area of. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page.

Georgia exempts a property owner from paying property tax on. Theyre a funding anchor for. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Complete Edit or Print Tax Forms Instantly. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Qualifying disabled veterans may be granted an exemption of 60000 plus an additional sum. Drawer 1435 Gainesville GA 30503 Phone. Provides for a 100 exemption from all ad valorem taxes levied for state county and school.

Georgia Sales Tax Small Business Guide Truic

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

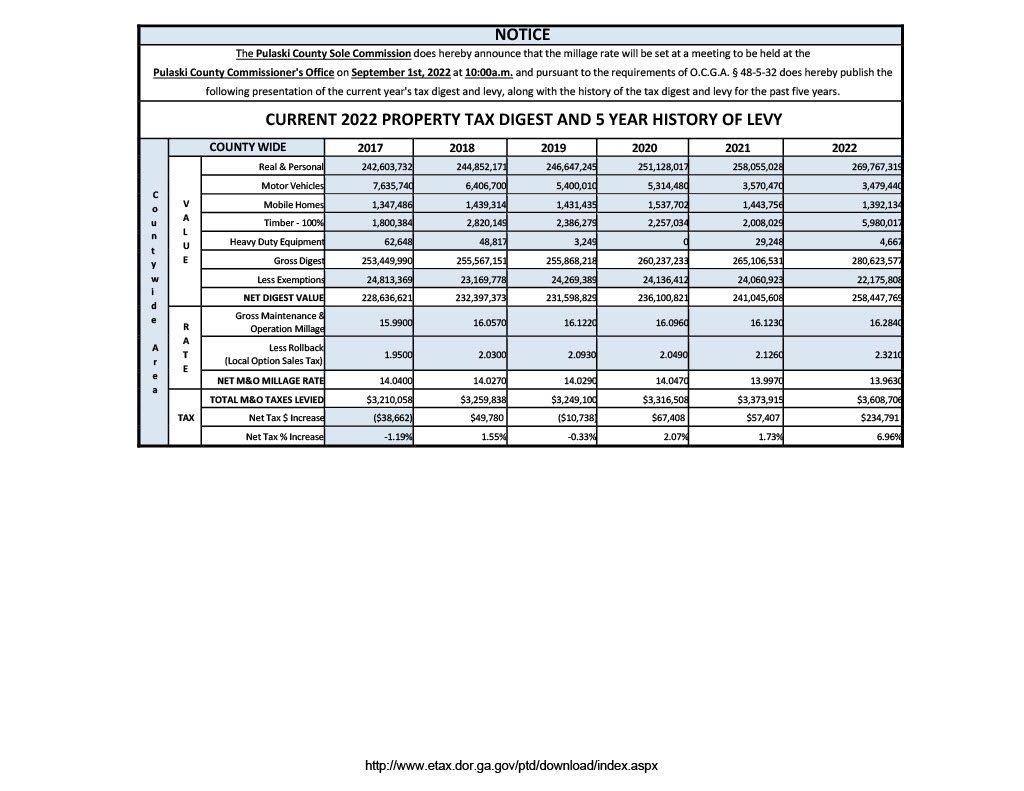

Tax Commissioner Hawkinsville Pulaski County

Hall County Ga Hallock Law Llc Property Tax Appeals

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Polk County Georgia Tax Commissioner

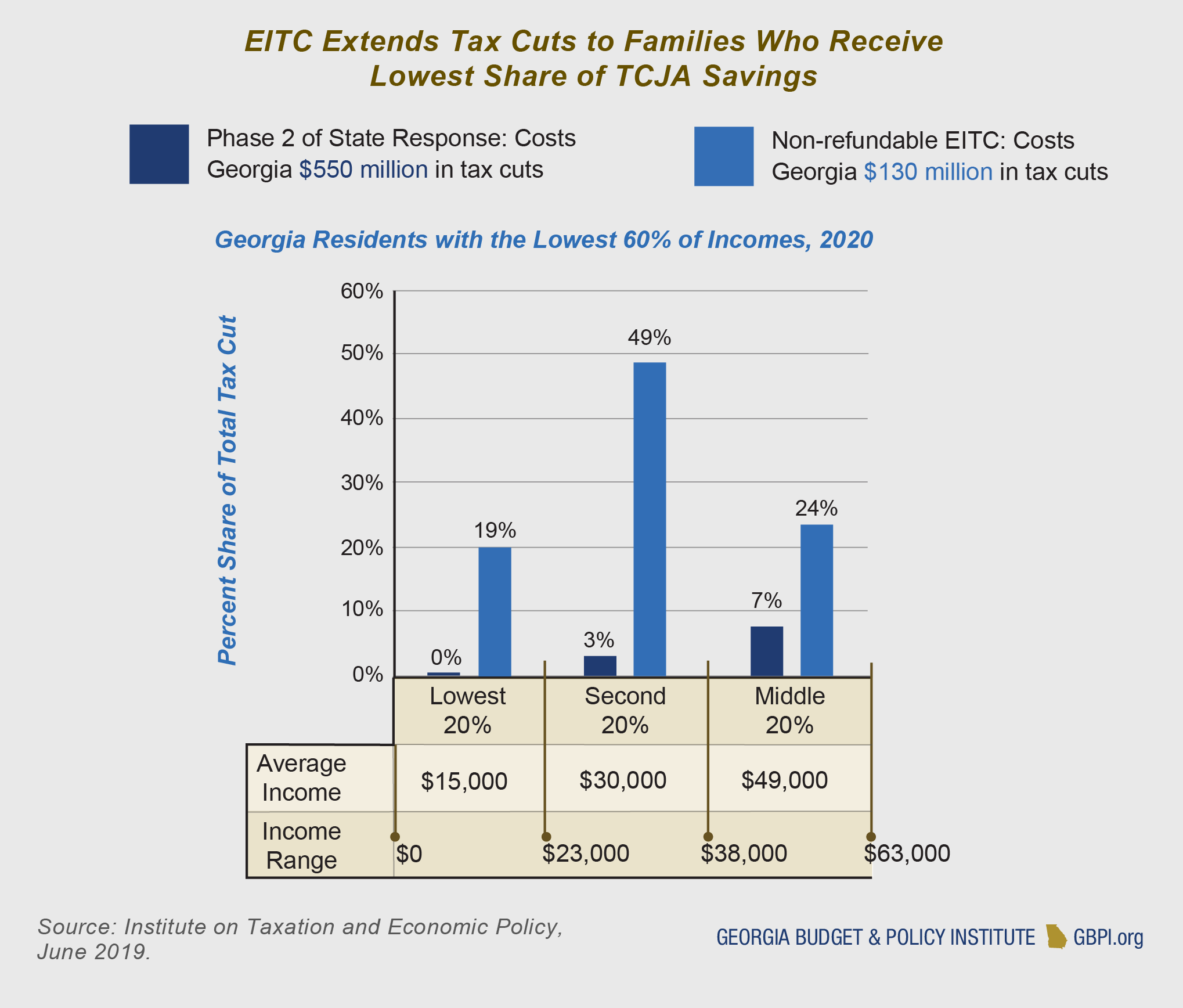

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Tax Calculator Estimator For Real Estate And Homes

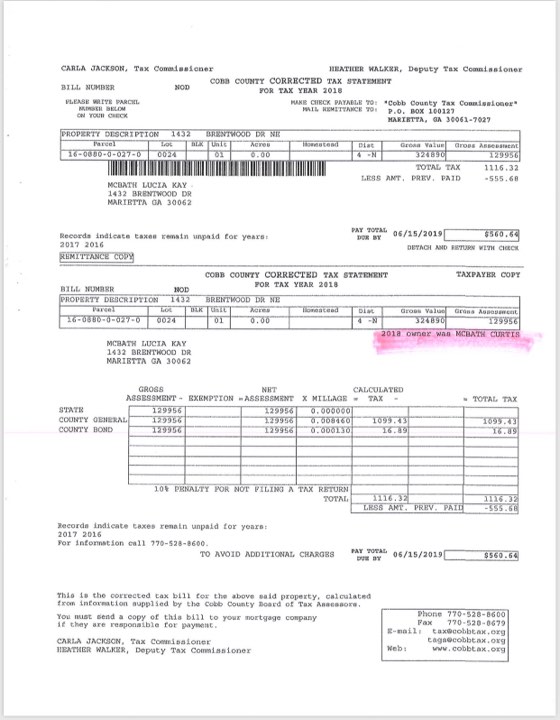

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Apply For Property Tax Exemptions Now To Save Next Year The Clayton Crescent

Homestead Other Tax Exemptions

Gsccca Org Pt 61 E Filing Help

Homestead Exemption Codes Qpublic

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Governor Signs Tax Reduction And Reform Act Of 2022 Mauldin Jenkins

How To Register For A Tax Exempt Id The Home Depot Pro

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute